WASHINGTON: Global public debt is on track to exceed 100% of global GDP by 2029, reaching its highest level since 1948, the International Monetary Fund (IMF) warned on Wednesday, urging governments worldwide to rebuild fiscal buffers and curb rising risks to economic stability, Reuters reported.

According to Vitor Gaspar, head of the IMF’s Fiscal Affairs Department, public debt could surge to 123% of global GDP by the end of the decade under an “adverse but plausible” scenario — just below the post–World War II peak of 132%.

“The most concerning situation would be one in which financial turmoil takes hold,” Gaspar cautioned, referencing the IMF’s latest Fiscal Monitor report, which warned of potential “disorderly” market corrections that could trigger a fiscal-financial ‘doom loop’ reminiscent of the 2010 European debt crisis.

Rising Economic Risks and Fiscal Challenges

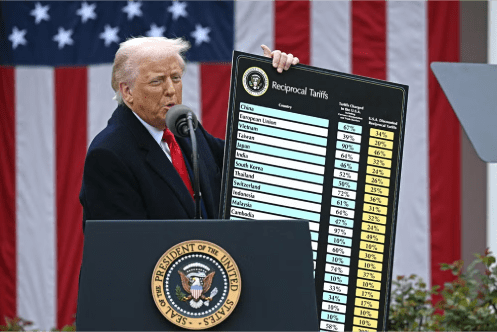

While the IMF slightly raised its 2025 global growth forecast, it warned that an escalating US–China trade war could significantly weaken global output. Gaspar stressed that both advanced and developing economies must now prioritise debt reduction, fiscal reform, and deficit control.

“With significant risks on the horizon, preparation is crucial — and that requires building fiscal buffers to respond effectively to severe shocks,” Gaspar said.

The IMF noted that high-income economies such as the United States, Canada, China, France, Italy, Japan, and the United Kingdom already have public debt levels exceeding or nearing 100% of GDP. While these nations benefit from deep financial markets and policy flexibility, many emerging and low-income countries face higher borrowing costs and limited fiscal space.

Rising Borrowing Costs and Global Pressures

Gaspar observed that borrowing has become far more expensive than during the post–2008 financial crisis and pandemic years. Rising interest rates are straining public budgets amid geopolitical tensions, natural disasters, technological disruptions, and aging populations.

“While the fiscal equation is politically difficult, the time to prepare is now,” Gaspar warned in the Fiscal Monitor’s foreword, emphasizing that well-targeted spending on education and infrastructure could support long-term growth.

Investing in Human Capital

The IMF highlighted that reallocating just 1% of GDP from current spending to education or human capital investment could raise GDP by over 3% by 2050 in advanced economies — and nearly double that in emerging markets.

US and China Debt Outlook

The IMF noted that US public debt, which surpassed post-WWII levels during the Covid-19 pandemic, is projected to reach 140% of GDP by 2030. Gaspar said the Fund will urge Washington to narrow its budget deficit in its upcoming economic review next month, arguing that doing so would “rebalance the US economy” and ease global financial pressures.

Meanwhile, China’s public debt is also rising sharply — from 88.3% of GDP in 2024 to a projected 113% by 2029. The IMF plans a similar review of China’s fiscal and economic outlook next month.

The Fund concluded that without decisive fiscal action, the world could be heading toward debt levels unseen since the aftermath of World War II, posing serious risks to global financial stability.

By Reuters